Colorado 2025 Tabor Refund With Tax Filing Requirements. Colorado taxpayers are in line for almost $67 million in taxpayer's bill of rights refunds that should have been paid years ago due, the result of an error by the state controller in determining what should — or shouldn't — be counted as tabor revenue in the state's reinsurance program. Did prop hh failure affect tax refunds?

Were at least 18 years old when the tax year began, have a colorado income tax liability, or. Colorado residents will get a tax refund worth $800 per filer on their 2025 taxes through tabor.

TABOR refund checks are in the mail for Coloradans CBS Colorado, You must file a colorado state income tax return or a ptc rebate application to receive your tabor refund. Meanwhile, house bill 1052, which would tap tabor surplus for $33.8 million, provides a refundable tax credit in 2025 only to seniors who have not taken the senior homestead exemption and whose incomes do not exceed $75,000 or $125,000 if filing jointly.

Tabor Tax Refund, Are required to file a colorado return because you are required to file a federal return. Each qualified taxpayer will get a colorado tabor refund 2025 of $800 in 2025,.

When Will 2025 Tabor Refund Be Issued Adda Livvie, When will i get my colorado tax refund? Colorado residents will get a tax refund worth $800 per filer on their 2025 taxes through tabor.

/do0bihdskp9dy.cloudfront.net/08-23-2022/t_4dc0a83d228e41c5b0fe1d0ba820e5d2_name_file_1280x720_2000_v3_1_.jpg)

State of Colorado sending out TABOR refund checks. Don't accidentally, File a 2025 colorado individual income tax return: Each qualified taxpayer will get a colorado tabor refund 2025 of $800 in 2025, while two qualifying taxpayers filing jointly will receive a refund of $1,600.

Senior Tax Credit/Tabor Refund Colorado Gerontological Society, Denver ( kdvr) — after a delayed start in. If you are eligible to claim your tabor refund, you must file a 2025 dr 0104 by april 15, 2025, if you:

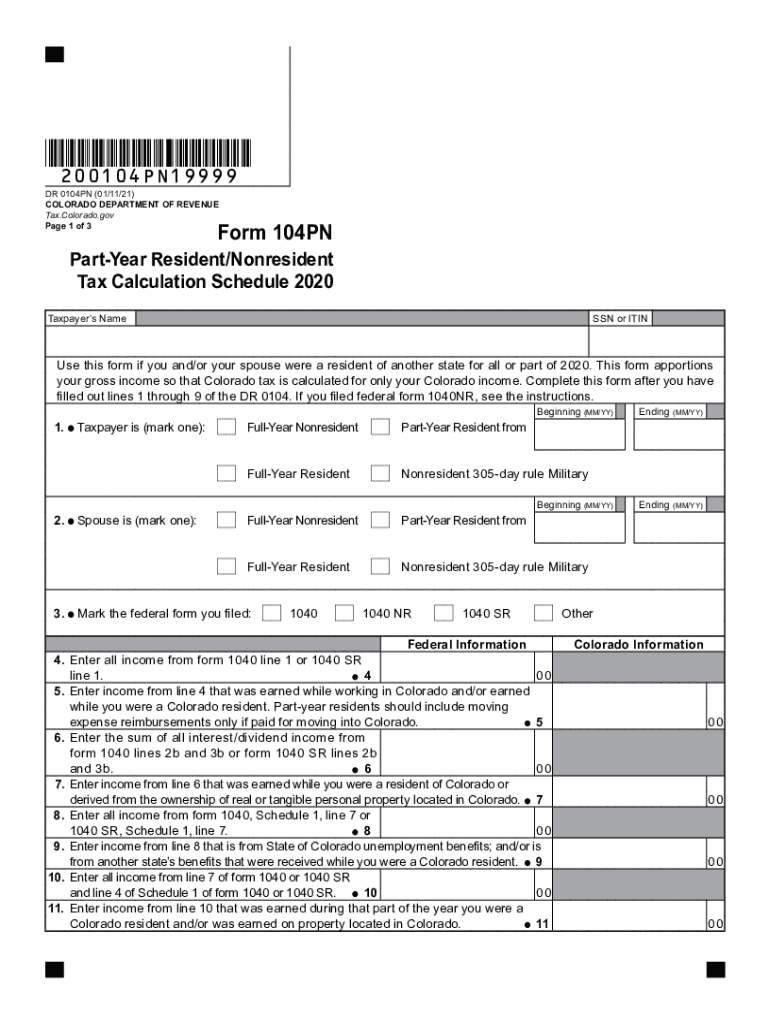

Colorado 104pn 20202025 Form Fill Out and Sign Printable PDF, The state is forecast to refund $1.8 billion at tax filing next year, $1.9 billion the year after and $2.3 billion in 2027. Coloradan taxpayers can each expect an extra $800 back when they file their state income taxes early next year via tabor, state officials said wednesday in a hearing by the joint budget committee.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, On may 14, 2025, colorado governor jared polis approved legislation that revises taxpayer's bill of rights (tabor) refund mechanisms, including reactivating the temporary income tax rate reduction for income tax years 2025 through 2035 and establishing a fourth refund mechanism that temporarily reduces state sales and use tax. Meanwhile, house bill 1052, which would tap tabor surplus for $33.8 million, provides a refundable tax credit in 2025 only to seniors who have not taken the senior homestead exemption and whose incomes do not exceed $75,000 or $125,000 if filing jointly.

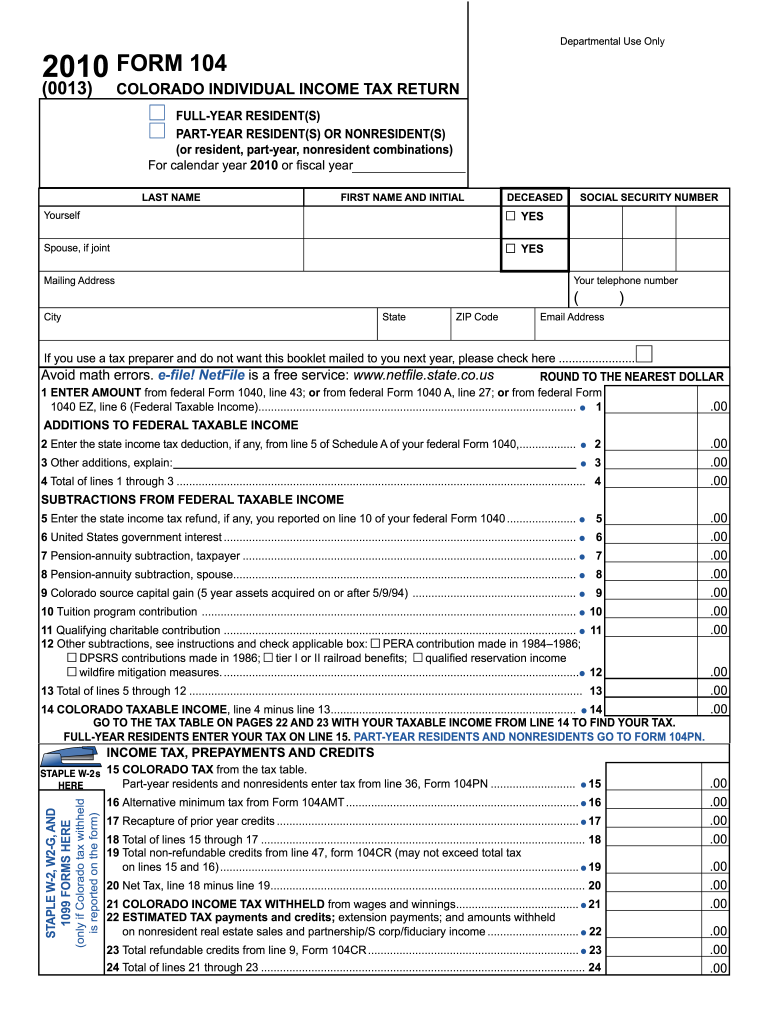

Colorado form 104 Fill out & sign online DocHub, If you claimed a 2025 refund, the tabor refund will be combined and issued out with your refund. Denver — the majority of coloradans are eligible to receive $400 or $800 checks from the state government due to the taxpayer bill of rights (tabor) passed in.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, When will i get my colorado tax refund? The tabor refund comes after filing your colorado income taxes, but it doesn’t always come automatically and must be claimed.

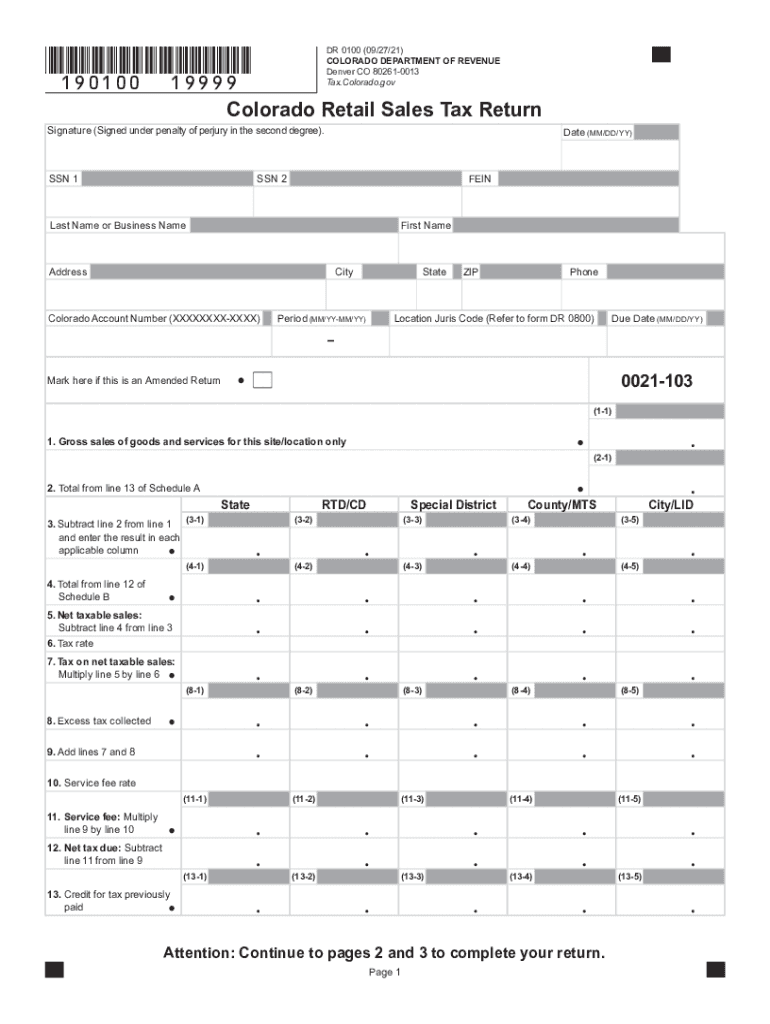

Dr Colorado Revenue 20212025 Form Fill Out and Sign Printable PDF, Coloradan taxpayers can each expect an extra $800 back when they file their state income taxes early next year via tabor, state officials said wednesday in a hearing by the joint budget committee. Denver — the majority of coloradans are eligible to receive $400 or $800 checks from the state government due to the taxpayer bill of rights (tabor) passed in.

Coloradan taxpayers can each expect an extra $800 back when they file their state income taxes early next year via tabor, state officials said wednesday in a hearing by the joint budget committee.

Best Rated Sheets 2025. Consider brooklinen's classic percale core sheet set the bedding version of. […]